Factors Influencing Business Credit Scores: What Affects Business Credit Scores

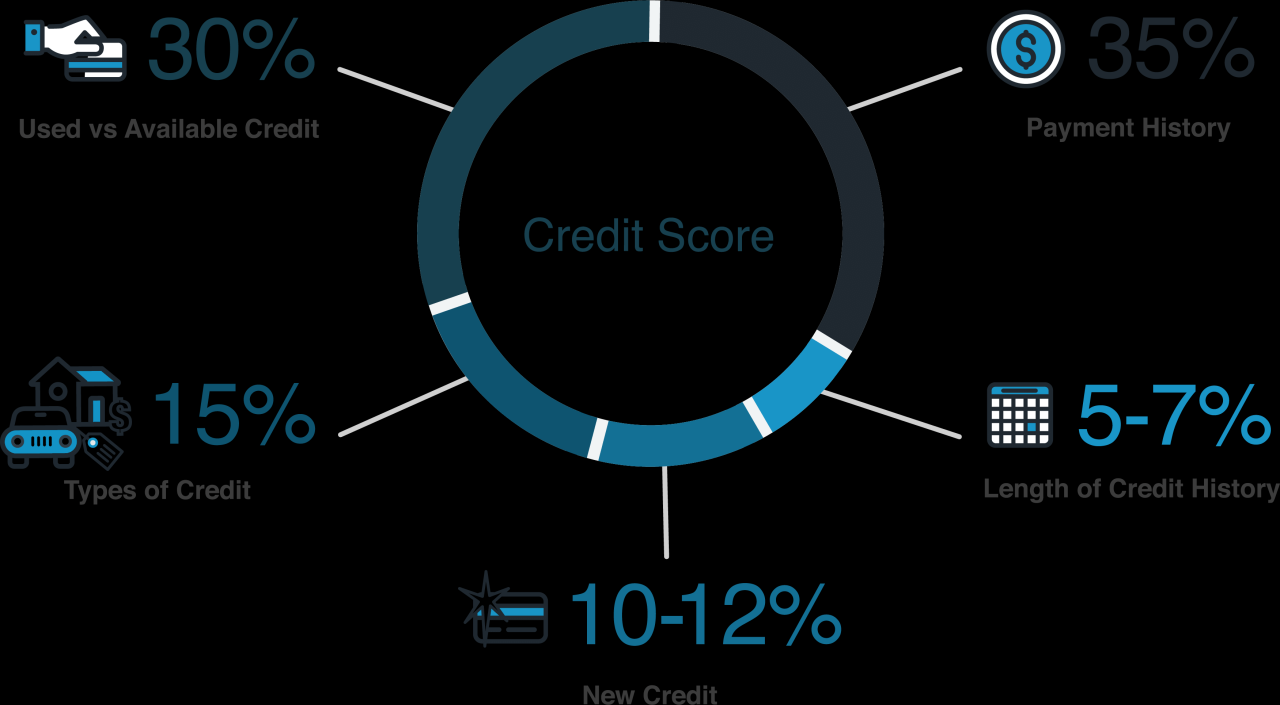

What affects business credit scores – A business credit score is a numerical representation of a company’s creditworthiness, calculated based on its financial history and other factors. Several elements influence business credit scores, including payment history, credit utilization, length of credit history, and types of credit used.

Payment History, What affects business credit scores

Payment history is one of the most critical factors affecting business credit scores. Consistent and timely payments demonstrate financial responsibility and reliability, while late or missed payments negatively impact scores. Lenders view a history of prompt payments as an indicator of a company’s ability to manage its financial obligations effectively.

- Positive Payment Behaviors:Making all payments on time, every time, establishes a strong payment history.

- Negative Payment Behaviors:Late or missed payments, even one instance, can significantly lower credit scores. Consistent late payments indicate a pattern of financial irresponsibility.

Maintaining a consistent payment schedule is crucial for building a positive payment history. Automated payment systems or reminders can help businesses avoid missed or late payments.

Credit Utilization and Debt Management

Credit utilization, also known as debt-to-credit ratio, measures the extent to which a business uses its available credit. It plays a significant role in determining business credit scores, as it reflects the business’s ability to manage its debt responsibly.

Credit utilization is calculated by dividing the total amount of outstanding debt by the total amount of available credit. A lower credit utilization ratio indicates that the business is not overextending itself and is using its credit wisely. Conversely, a high credit utilization ratio raises concerns about the business’s ability to manage its debt and can negatively impact its credit score.

Optimal Credit Utilization Percentages

Credit bureaus typically recommend maintaining a credit utilization ratio below 30%. The following table Artikels optimal credit utilization percentages for different credit score ranges:

| Credit Score Range | Optimal Credit Utilization |

|---|---|

| 760 and above | Less than 10% |

| 700-759 | Less than 15% |

| 650-699 | Less than 20% |

| 600-649 | Less than 25% |

| Below 600 | Less than 30% |

It’s important to note that exceeding credit limits or carrying high balances can damage a business’s credit score. This is because it indicates that the business is struggling to manage its debt and may be at risk of defaulting on its obligations.