Understanding Business Credit Limits

How to raise business credit limits – Business credit limits are predetermined amounts of money that lenders extend to businesses for borrowing purposes. These limits are established based on various factors, including the business’s financial health, credit history, and industry. Maintaining healthy credit limits is crucial for businesses as it allows them to access funding when needed, build strong relationships with lenders, and negotiate favorable terms on loans and other financing options.

Factors Determining Credit Limits

- Financial Health:Lenders assess the business’s financial performance, including its profitability, cash flow, and debt-to-equity ratio, to determine its ability to repay borrowed funds.

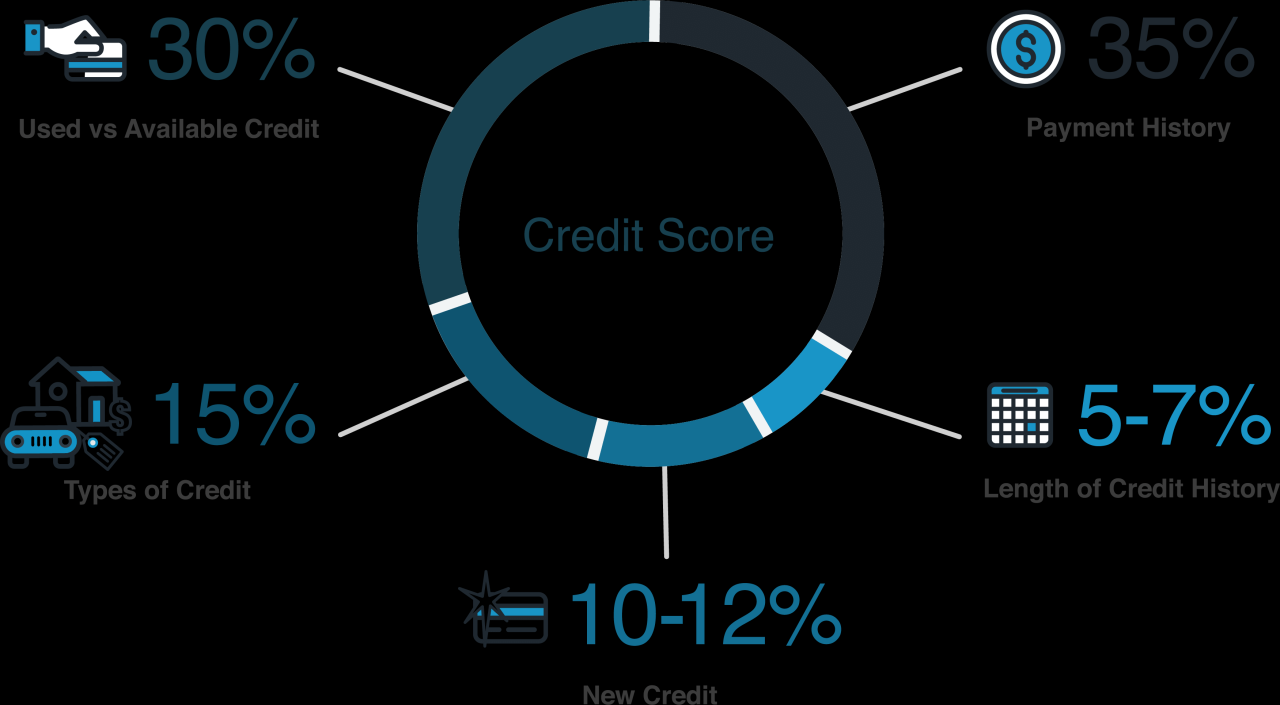

- Credit History:A business’s track record of timely payments and responsible borrowing is a key factor in setting credit limits. A strong credit history demonstrates the business’s reliability and reduces the perceived risk for lenders.

- Industry:The industry in which the business operates can also influence credit limits. Lenders may have different risk appetites for different industries based on their historical performance and perceived stability.

Importance of Maintaining Healthy Credit Limits

- Access to Funding:Healthy credit limits provide businesses with the flexibility to access additional funding when needed, such as for expansion, inventory purchases, or unexpected expenses.

- Strong Lender Relationships:Maintaining healthy credit limits helps businesses build strong relationships with their lenders, which can lead to favorable terms on future loans and financing.

- Negotiating Power:Businesses with healthy credit limits have more negotiating power when it comes to interest rates, fees, and other loan terms.

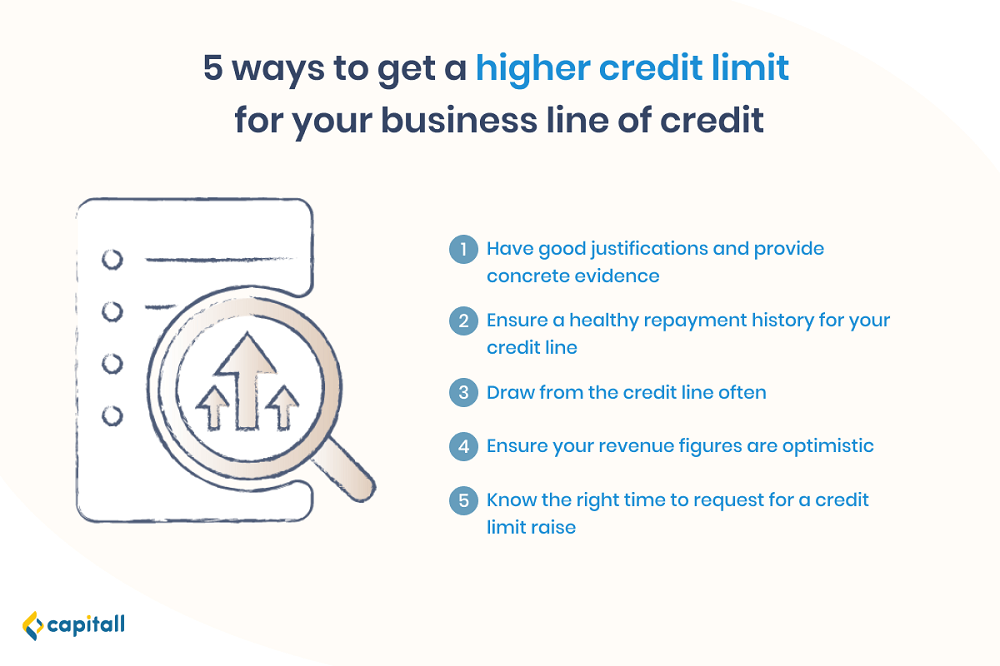

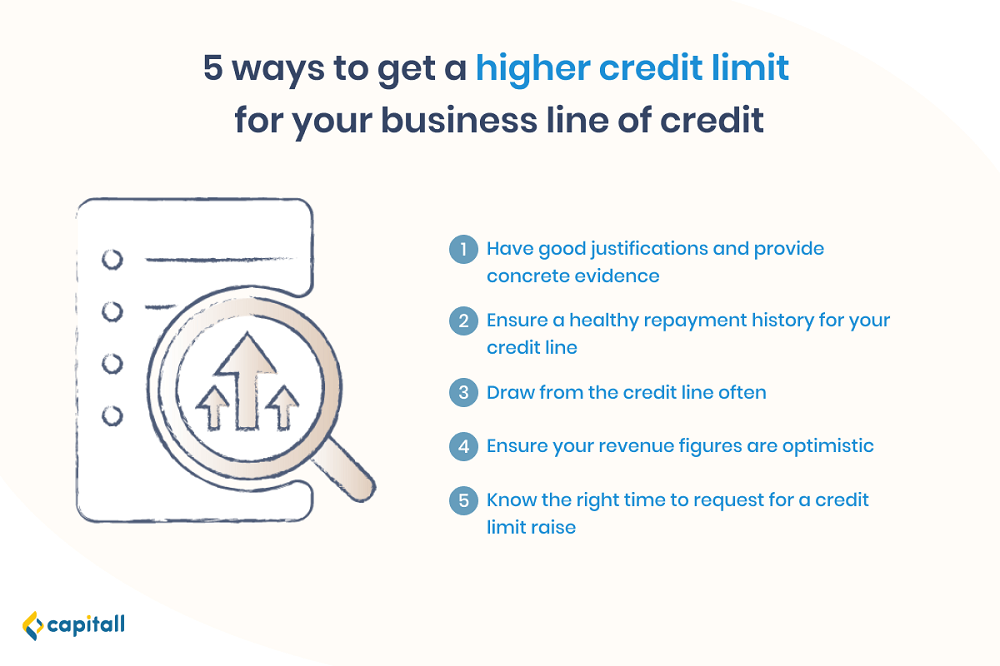

Maintaining and Monitoring Credit Limits: How To Raise Business Credit Limits

Maintaining healthy credit limits and monitoring credit usage are crucial for businesses to maintain financial stability and avoid negative consequences.Maintaining credit limits involves regularly reviewing and adjusting them based on business needs and financial performance. It’s important to avoid overextending credit, as it can strain cash flow and lead to financial distress.Monitoring credit usage involves tracking how much credit is being used and ensuring that it stays within the established limits.

This helps businesses identify potential issues early on and take corrective actions to avoid exceeding limits.

Consequences of Exceeding Credit Limits

Exceeding credit limits can have severe consequences, including:

- Late payment fees and penalties

- Damage to business credit score

- Reduced access to future credit

- Difficulty in securing favorable loan terms

- Loss of vendor relationships

Therefore, it’s essential for businesses to maintain healthy credit limits and monitor their credit usage closely to avoid these negative outcomes.

Case Studies and Examples

Businesses that have effectively raised their credit limits often share common strategies and approaches. Let’s explore some real-world examples and create a table to compare different methods for raising credit limits.

Success Stories

- Company A:A manufacturing company successfully increased its credit limit by 30% after implementing a robust credit management system that automated processes and improved vendor relationships.

- Company B:A retail chain saw a 20% increase in its credit limit by optimizing its payment terms and establishing strong payment histories with suppliers.

- Company C:A construction firm raised its credit limit by 40% after securing additional collateral and providing detailed financial projections to its lender.

Table: Methods for Raising Credit Limits

| Method |

Pros |

Cons |

| Increase Sales Volume: |

Demonstrates increased revenue and stability. |

May require significant time and effort to achieve. |

| Improve Payment History: |

Establishes reliability and creditworthiness. |

Can take time to build a strong payment history. |

| Secure Additional Collateral: |

Provides lenders with additional security. |

May not be feasible for all businesses. |

| Provide Financial Projections: |

Demonstrates financial stability and future growth potential. |

Accuracy and reliability of projections are crucial. |

| Negotiate with Lenders: |

Can be effective if the business has a strong relationship with the lender. |

May not always be successful. |

Lessons Learned, How to raise business credit limits

- Importance of Strong Financial Management:Businesses with well-managed finances are more likely to qualify for higher credit limits.

- Value of Vendor Relationships:Building positive relationships with suppliers can facilitate access to better credit terms.

- Impact of Payment History:Consistent and timely payments are essential for maintaining and raising credit limits.

Additional Considerations

Understanding additional factors that influence business credit limits is crucial for effective credit management. This section explores the role of credit monitoring services, the impact of personal credit on business credit limits, and provides resources for further research.

Credit Monitoring Services

Credit monitoring services can provide valuable insights into your business credit profile. These services track your credit reports from multiple bureaus and alert you to any changes or potential risks. By monitoring your credit regularly, you can identify potential issues early on and take steps to address them.

Personal Credit Impact on Business Credit Limits

In some cases, your personal credit history may also impact your business credit limits. This is especially true if you are a sole proprietor or have a small business with limited credit history. Lenders may consider your personal creditworthiness as an indicator of your ability to manage financial obligations.

Resources for Further Research

- Dun & Bradstreet: Business Credit Reports

- Experian: Business Credit

- Equifax: Small Business Credit Reports