Business Credit Building Strategies

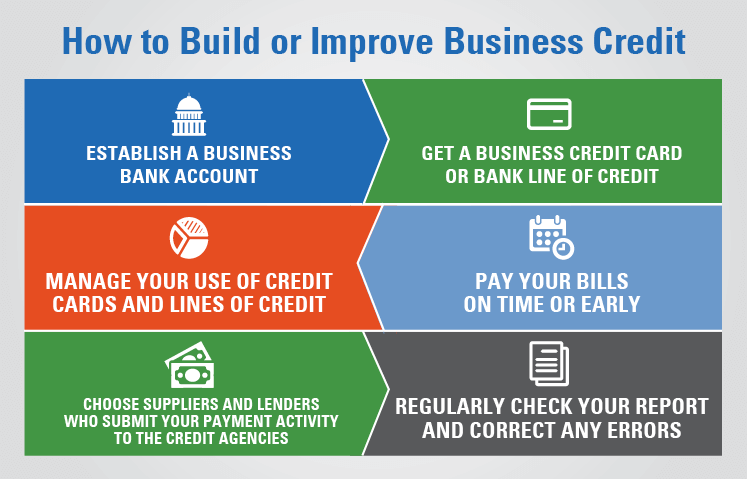

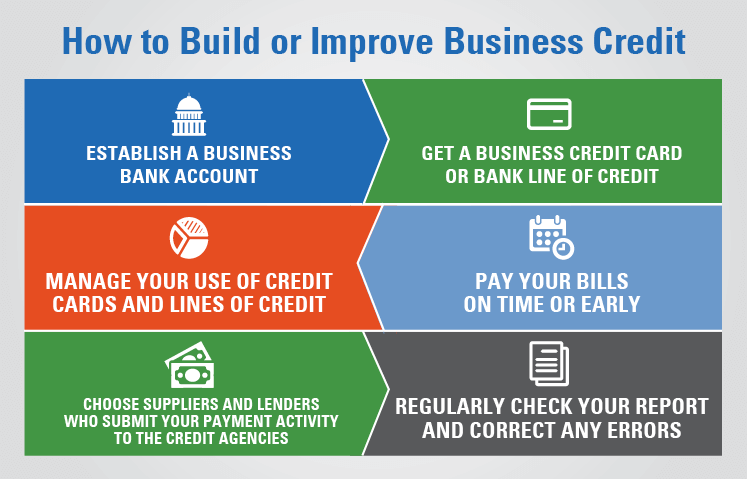

Business credit strategies for growth – Establishing and maintaining a strong business credit profile is crucial for accessing financing, building business relationships, and securing favorable terms on loans and lines of credit. Here are key strategies to build and manage your business credit:

Establish a Legal Business Entity

Registering your business as a legal entity, such as an LLC or corporation, separates your personal and business finances and establishes a separate credit identity for your business.

Obtain an Employer Identification Number (EIN)

An EIN is a unique identifier assigned to your business by the Internal Revenue Service (IRS). It is used to open business credit accounts and establish your business’s credit history.

Build Trade Credit

Establishing trade credit with suppliers and vendors by making timely payments on invoices and bills can help build your business’s credit history.

Use Business Credit Cards

Using business credit cards responsibly, by making on-time payments and keeping balances low, can contribute to your business’s credit score.

Obtain Lines of Credit

Securing lines of credit from banks or other lenders can provide access to additional financing and help improve your business’s creditworthiness.

Monitor Your Business Credit

Regularly monitoring your business credit reports from credit bureaus such as Dun & Bradstreet and Experian can help you identify any errors or issues that need to be addressed.

Improve Your Business Credit Score

By implementing these strategies, you can improve your business credit score, which will open up access to more favorable financing options and strengthen your business’s financial standing.

Credit Utilization and Management: Business Credit Strategies For Growth

Credit utilization and management play a crucial role in establishing and maintaining a strong business credit profile. Understanding the impact of credit utilization ratio and implementing effective strategies for managing credit limits and debt-to-income ratio can significantly contribute to business growth.

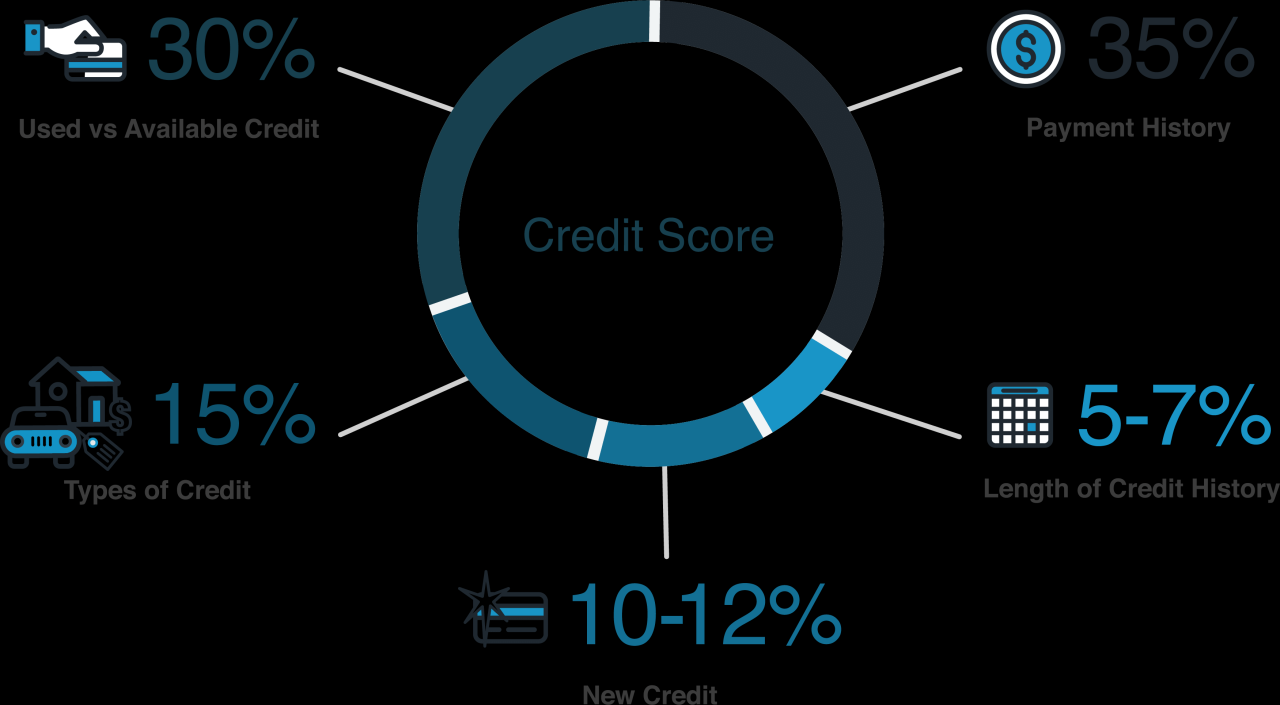

Credit Utilization Ratio

Credit utilization ratio measures the amount of credit used compared to the total credit available. A high credit utilization ratio indicates that a business is using a large portion of its available credit, which can negatively impact its credit score.

Aim for a credit utilization ratio below 30% to demonstrate responsible credit management.

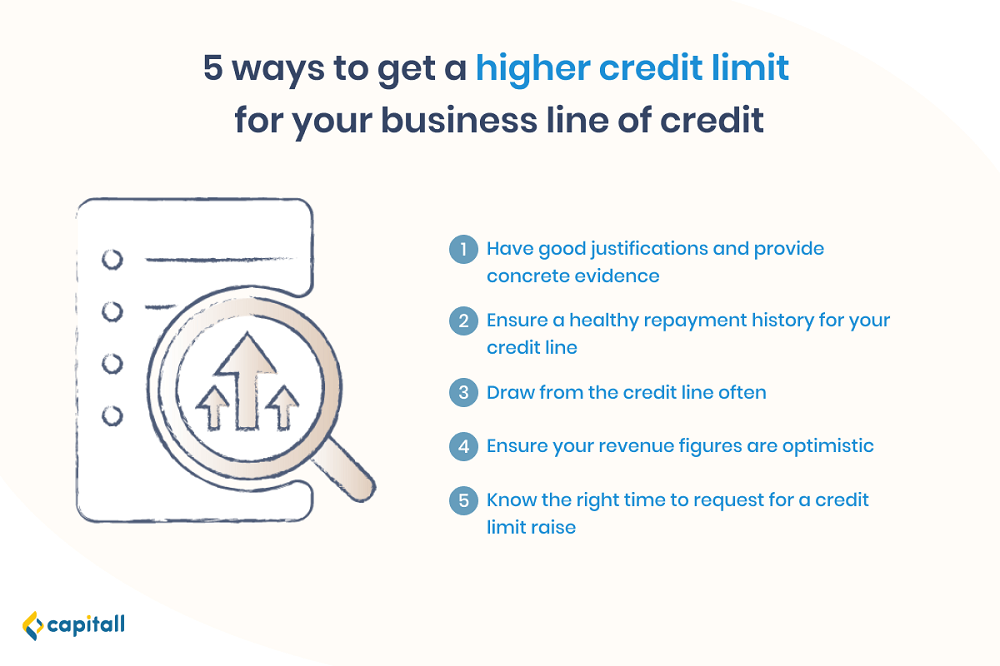

Managing Credit Limits

Regularly review credit limits and request increases when necessary to avoid exceeding the credit utilization ratio. Avoid using all available credit, even if the business has the capacity to do so. Instead, maintain a buffer of unused credit to maintain a low credit utilization ratio.

Managing Debt-to-Income Ratio

Debt-to-income ratio compares the total monthly debt payments to the total monthly income. A high debt-to-income ratio can make it difficult to qualify for new credit or secure favorable interest rates. Keep the debt-to-income ratio below 36% to demonstrate financial stability and creditworthiness.

Optimizing Credit Usage for Growth

- Diversify credit sources:Establish credit relationships with multiple lenders to reduce reliance on a single source and improve the credit mix.

- Negotiate favorable terms:Explore options for lower interest rates, extended payment terms, and reduced fees to minimize the cost of borrowing.

- Monitor credit reports regularly:Track credit scores and reports to identify any errors or potential issues that could impact creditworthiness.

Alternative Financing Options

Traditional financing options such as bank loans and lines of credit may not always be accessible or suitable for businesses, especially startups or those with limited credit history. Alternative financing options provide businesses with additional avenues to secure funding and support their growth.

Invoice Factoring

Invoice factoring involves selling unpaid invoices to a third-party factoring company. The factoring company advances a percentage of the invoice amount, typically between 70% and 90%, to the business. Once the customer pays the invoice, the remaining balance, minus the factoring fee, is remitted to the business.

Pros:

- Quick access to cash without waiting for customers to pay.

- Reduces the burden of managing accounts receivable.

- May be an option for businesses with slow-paying customers.

Cons:

- Factoring fees can be expensive.

- May not be suitable for businesses with a large volume of small invoices.

- Can damage relationships with customers who are not aware of the factoring arrangement.

Asset-Based Lending

Asset-based lending involves using a business’s assets, such as inventory, equipment, or real estate, as collateral for a loan. The loan amount is typically based on a percentage of the value of the assets pledged as collateral.

Pros:

- Can provide access to larger loan amounts than traditional financing.

- May be an option for businesses with limited credit history or low credit scores.

- Repayment terms can be flexible and tailored to the business’s cash flow.

Cons:

- Assets pledged as collateral may be subject to foreclosure if the loan is not repaid.

- Interest rates may be higher than traditional financing.

- May require a personal guarantee from the business owner.

Merchant Cash Advances

Merchant cash advances are short-term loans that are repaid through a percentage of the business’s daily credit card sales. The repayment period is typically 3 to 12 months, and the loan amount is typically based on the business’s average monthly credit card sales.

Pros:

- Quick access to cash without the need for collateral.

- Repayment is tied to the business’s sales, providing flexibility in cash flow.

- May be an option for businesses with limited credit history or low credit scores.

Cons:

- Interest rates and fees can be very high.

- May not be suitable for businesses with seasonal or unpredictable sales.

- Can damage relationships with customers if the business is unable to repay the loan on time.

Choosing the Best Alternative Financing Option

The best alternative financing option for a business depends on its specific needs and circumstances. Factors to consider include the amount of funding required, the repayment terms, the cost of the financing, and the potential risks involved. It is important to carefully evaluate each option and consult with a financial professional before making a decision.

Financial Projections and Business Planning

Financial projections are crucial for developing effective credit strategies as they provide a roadmap for the future financial performance of a business. By accurately forecasting revenue, expenses, and cash flow, businesses can make informed decisions about their credit needs and how to allocate resources.

Realistic financial forecasts are essential for building credibility with lenders and investors, as they demonstrate a clear understanding of the business’s financial trajectory. Incorporating credit strategies into business plans allows businesses to align their financial goals with their overall business objectives, ensuring that credit is used strategically to support growth and profitability.

Importance of Realistic Financial Forecasts

Realistic financial forecasts are essential for several reasons. They help businesses:

- Identify potential cash flow shortfalls and make necessary adjustments.

- Secure financing by demonstrating the business’s ability to repay debt.

- Make informed decisions about investments and expansion.

- Monitor financial performance and make necessary course corrections.

Industry-Specific Credit Considerations

Different industries pose unique credit challenges due to varying risk profiles, cash flow patterns, and regulatory environments. Understanding these challenges and implementing tailored strategies is crucial for businesses to build and leverage credit for growth.

Industry-specific credit considerations include:

Unique Credit Challenges

- Construction:Cyclical industry with project-based cash flow, high upfront costs, and payment delays.

- Healthcare:Heavily regulated industry with slow payment cycles, high operating costs, and complex billing processes.

- Technology:Fast-paced industry with high R&D expenses, rapid obsolescence, and volatile cash flow.

li> Retail:Seasonal industry with thin margins, high inventory costs, and customer payment defaults.

Industry-Specific Strategies, Business credit strategies for growth

- Construction:Establish strong relationships with lenders specializing in construction financing, secure progress payments, and leverage bonding and insurance to mitigate risks.

- Healthcare:Optimize billing and collection processes, negotiate favorable payment terms with insurance providers, and explore alternative financing options such as medical equipment leasing.

- Technology:Focus on building strong financial projections, seek funding from venture capitalists or angel investors, and consider equipment leasing or software-as-a-service (SaaS) subscriptions to manage cash flow.

- Retail:Implement inventory management strategies to reduce holding costs, offer flexible payment options to customers, and establish relationships with factoring companies to accelerate cash flow.

Case Studies

- Construction:Skanska, a global construction company, leverages strong financial performance and industry expertise to secure credit lines and bonds for large-scale projects.

- Healthcare:CVS Health, a leading healthcare provider, optimizes billing and collection processes and partners with financial institutions to offer patient financing options.

- Technology:Uber, a ride-hailing company, utilizes technology to track driver performance, manage cash flow, and secure financing from investors.

- Retail:Amazon, an e-commerce giant, manages inventory efficiently, offers flexible payment options, and partners with third-party lenders to provide financing to customers.

Risk Management and Mitigation

Risk management and mitigation are crucial aspects of business credit strategies to ensure financial stability and growth. Identifying potential risks and implementing strategies to minimize their impact is essential for successful credit decision-making.

Common risks associated with business credit include:

- Default risk: The possibility that a borrower will fail to repay their debt.

- Interest rate risk: The potential for interest rate fluctuations to affect the cost of borrowing.

- Liquidity risk: The risk of not having enough cash on hand to meet financial obligations.

Strategies for Mitigating Credit Risk

Several strategies can be employed to mitigate credit risk, including:

- Diversification:Spreading credit risk across multiple borrowers or industries.

- Credit insurance:Purchasing insurance to protect against losses due to borrower default.

- Careful underwriting:Thoroughly evaluating borrowers’ creditworthiness before extending credit.

- Monitoring and early intervention:Regularly monitoring borrowers’ financial performance and taking proactive measures to address potential problems.

Balancing Risk and Reward

Balancing risk and reward is crucial in credit decision-making. Higher-risk borrowers may offer higher interest rates, but also pose a greater risk of default. Lenders must carefully weigh the potential rewards of increased yield against the potential risks of financial loss.

Factors to consider when balancing risk and reward include:

- The borrower’s creditworthiness

- The amount of credit being extended

- The purpose of the loan

- The lender’s risk tolerance

By implementing sound risk management and mitigation strategies, businesses can enhance their creditworthiness, secure favorable credit terms, and foster sustainable growth.

Technology and Automation in Credit Management

Technology has revolutionized credit management, offering tools and solutions that streamline processes, improve efficiency, and enhance decision-making.

One significant benefit of technology is the availability of credit monitoring tools. These tools provide real-time updates on credit scores, account activity, and potential fraud alerts. By automating this process, businesses can proactively identify and address any credit issues, reducing the risk of financial losses.

Automated Payment Systems

Automated payment systems streamline the process of making payments on time, reducing the risk of late payments and associated penalties. These systems can be programmed to automatically deduct payments from designated accounts on predetermined dates, ensuring timely fulfillment of financial obligations.

Enhanced Credit Strategies

Technology also empowers businesses to develop more informed and effective credit strategies. Data analytics tools can analyze historical credit data, identify trends, and predict future performance. This information can guide businesses in making informed decisions about extending credit to customers, setting credit limits, and managing risk.

Credit Repair and Recovery

Damaged business credit can be a significant obstacle to growth and success. Repairing damaged credit requires a strategic approach and a thorough understanding of the credit repair process.

Credit repair agencies can assist businesses in disputing inaccurate or outdated information on their credit reports. However, it’s crucial to note that the process can be time-consuming and may not always be successful.

Legal Options

- Fair Credit Reporting Act (FCRA):Provides consumers and businesses with the right to dispute inaccurate or outdated information on their credit reports.

- Fair and Accurate Credit Transactions Act (FACTA):Prohibits creditors from furnishing inaccurate information to credit reporting agencies.

- Equal Credit Opportunity Act (ECOA):Prohibits discrimination in credit transactions based on certain factors, including race, gender, and marital status.

In some cases, legal action may be necessary to resolve credit disputes. However, it’s important to consult with an attorney to assess the potential risks and benefits of legal action.

Recovering from Credit Challenges

Rebuilding a strong credit profile after experiencing credit challenges requires consistent effort and responsible financial management.

- Pay Bills on Time:Payment history is the most important factor in determining credit scores.

- Reduce Credit Utilization:Keeping credit card balances low relative to available credit limits demonstrates responsible credit usage.

- Monitor Credit Reports:Regularly reviewing credit reports allows businesses to identify and dispute any inaccuracies or errors.

- Build Positive Credit:Obtaining new credit accounts and managing them responsibly can help establish a positive credit history.

Recovering from credit challenges takes time and effort, but by following these strategies, businesses can rebuild their credit profiles and regain access to financing.